A business incubator was the ideal setting for this special UDEN meeting, which was held primarily to help the Salt Lake Disney/Avalanche employees whose studio will be closing next month. While we know them to be highly talented individuals who will have options in what they do next, we thought that perhaps some of them might use this opportunity to start something of their own. With that in mind, we want them to be as prepared as they can be. But our Disney friends weren't the only ones we had in mind: we opened the meeting to anyone interested in starting up on their own. Around 110 people attended, and by show of hands, more than half said they were interested in starting up or joining with others who wanted to startup. 5 people showed their hands when asked if only along for the food :-)

Our sponsors for the evening were the Holodeck, the business incubator downtown SLC, and WildWorks, who catered the event with "startup food" - all that was missing were the Ramen noodles! Let me put on record our huge thanks to them for their generosity, also to our expert panel who gave their time and expertise to his important cause.

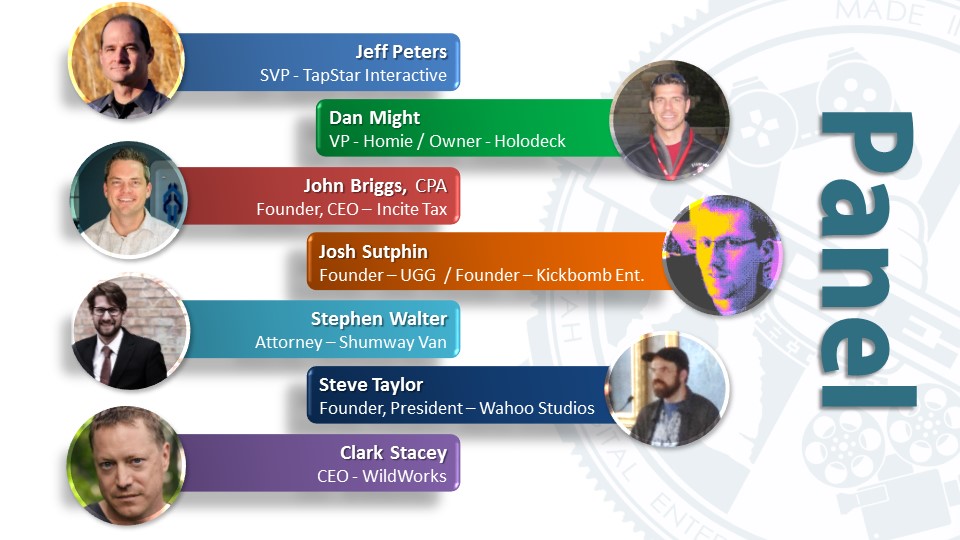

“The Panel:

CLARK STACEY, Co-founder, CEO, WildWorks

One of the best-known local “indie” developers is WildWorks, who came to life as a startup called ‘SmartBomb’ in 2003. Clark helped navigate fund-raising and the careful growth of WildWorks to around 125 developers including a studio in Europe.

STEPHEN WALTER, Attorney, Shumway Van

Stephen’s legal practice focuses on entrepreneurship, venture capital, and general business law. He is a director of StartSLC, Utah’s largest startup festival, and an organizer of 1 Million Cups in Salt Lake City. Stephen also contributes to Beehive Startups, where he writes about venture finance and other legal and business issues.

STEVE TAYLOR, Founder, President, Wahoo Studios

Wahoo celebrate 15 years in business this year. They have run the gamut of almost every type of platform and business model, published their own IP as well as undertaken contractual work for the big guys. It hasn’t been easy, with ups and down, as Steve told us at one of our earlier UDEN meetings.

JOHN BRIGGS, CPA, Founder, CEO, Incite Tax

Having created a startup business himself, John works with many small businesses acting as their “outsourced CFO”, a cash-efficient service providing advice and education on financial operations, accounting and taxes.

DAN MIGHT, VP Operations, Homie; Owner, Holodeck

Together with his brother John, Dan started Holodeck, a downtown SLC coworking space which they merged with DeskHub a little over a year later. He also oversees operations for Homie, a Utah startup in the housing market that allows buyers and sellers to work directly together, saving commissions. Oh!, He also helped start a little company called Uber!

JOSH SUTPHIN, Co-founder Utah Games Guild; Founder, Kickbomb Entertainment

An outspoken indie game developer and active contributor to growing the game dev community in Utah, Josh has been instrumental in promoting the work of small local developers at various conventions as well as helping young students get excited about the industry.

JEFF PETERS, SVP, TapStar Interactive

A seasoned game developer, Jeff has started “indie” studios as well as managed multi-million dollar franchises for major publishers. Currently focused on all things digital, including freemium and free-to-play business models, as a senior industry consultant, board member and executive leader within multiple organizations. Jeff was recently featured by SyFy Games, as part of their “ICON” Feature, for overall career impact and ongoing contributions to the industry as a whole.”

Jeff Peters introduced and moderated the panel. Among the topics discussed were:

How to start your business correctly:

- Setting it up correctly from the outset will save you nightmares down the road;

- Consult with a lawyer and an accountant; yes they'll cost you a little money but they'll help you think about things you probably haven't;

- Choose the right legal structure (LLC, S-corp, C-corp etc) for tax and business purposes;

- Stephen offered to create the paperwork you need for $500;

- John mentioned that the tax code is crazy and warned that the IRS don't care about you or your situation, but making some smart decisions upfront can help you avoid double taxation;

- Choose your lawyer and accountant the same way you would a fellow employee or sub-contractor; ask for recommendations from people you know (who do they use?); interview the potential accountants or lawyers; get references from existing clients in your industry

- Have serious conversations with your business partners now - set the right expectations between you for your business relationship: agree % ownership; who gets paid what when the money comes in; roles and responsibilities; expected working hours; what happens if the money doesn't come in? What process will you use to resolve any disagreements? What timeline are you each committing to make the business successful? What happens if one of you dies? What happens if one of you wants to leave? etc.

Differences between working in a large company and a startup:

In a startup:

- You're the boss!

- You get to set the working hours - they may be long, you may not get vacations;

- You understand everything going on inside the business (you see the problems);

- The pay checks may be infrequent;

- Get it right and the rewards can be significant!

In a large company:

- You're working to make someone else rich - but they're taking all of the risk;

- You abide by the company rules;

- You don't get visibility into everything (you typically don't see the problems that might cause you to lose your job);

- Paid vacation!

- Benefits!

- Regular pay check!

- Do a great job and maybe you get a pay rise and a promotion

Financing your startup:

No matter how you begin - perhaps working from home unpaid for 6 months (for sweat equity) - you typically can't sustain that bootstrap financing model for very long: at some point the business has to have money so that you and your colleagues can pay their mortgages, send kids to college etc. You can hope that your product will immediately make money, but if it doesn't... what then? Perhaps you do make money but to keep things going, you need to put more money in than you had originally thought (draining your resources faster than planned) - what then?

Your "runway" is how long you can stay in business with your existing funds. Make sure to know how long this is and that you start to work on alternates before you reach the end of the runway.

At some point, you'll realize you are running out of runway. Maybe you haven't been as successful as you thought, but equally, perhaps you were more successful than you thought you would be and now you need cashflow to pay for materials, suppliers etc, to keep the business moving.

To extend your runway you need an injection of money into your business; this can come in many forms:

- Family - loans from your loved ones;

- Savings - perhaps you have a nest-egg of savings, maybe you have a severance payment you could use;

- Bank loans;

- Grants (local small business incentives etc);

- Competition prize money;

- Selling shares in your business (to an investor)

Each of these needs to be considered on their merits: failing to repay comes with consequences so make sure to go in with eyes open.

Investors

These are people (or businesses) that will give you money by buying shares in your business. Like any professional money lender, they want the best deal they can get for themselves - meaning as much of your business for as small amount of money as possible. They will also want some degree of control or say in how the business moves forward as a means to protect their investment. But that assumes they're interested in the first place - getting their interest can be hard. After all, they could put their money into a savings account, which will return a small but guaranteed percentage of interest for them. If they instead invest that money with you, they know that they may not get any return at all (their risk), so they'll want to know that your business offers them a good chance of earning many times more than in that savings account (the reward for the risk). This is why you need to work at getting their interest (Clark described it as having a "compelling story to tell")!

Generally there are two types of investor:

Angels - these tend to be wealthy individuals that are entrepreneurs looking for interesting ways to use their money. They want a good return on their investment. Angels tend to invest smaller amounts of money at any one time and are open to investing in new startups ("seed capital" - their money is used to get things going).

Venture Capital (VC) - these are businesses usually comprised of many investors who pool their money to make larger investments. As such, they tend to put money into the next stages of growth for companies - i.e. ones that already have established some level of business and are looking to take it to the next level, so need investment money to grow and take advantage of whatever opportunity lies before them.

Both investor types exist in Utah but they tend to invest in more predictable businesses, like renewable energy or healthcare. All investors want to understand the risk they take when investing and so they are nervous about high risk ventures - such as films and videogames - which tend to be hit driven and are less predictable. Investors are more likely to be interested in the next big tech thing as an investment, than something currently popular.

To pitch an investor, you need to have all of your business materials properly structured and ready for their scrutiny. UDEN plan to cover much of this at our July 2016 meeting! Assuming that your business 'ducks are in a row' they will make a large part of their decision based on their confidence in you - yes, you and your colleagues; how confident are they that you have the expertise and the experience to deliver on this compelling story you told them!

It was a really excellent evening; a lot of passion shown by the panel (who didn't always agree) as well as the audience who were willing participants throughout. The networking that followed went on for more than 2 hours, it was great to see so much interaction and networking occurring. A video of the event will follow at our YouTube page and don't forget to checkout the new resources page on the UDEN website, which captures a lot of this information in more detail.

Special shout-out also to Jeff Peters and AJ Dimick for their help organizing these events, setting up, filming and then editing the videos for our events!

If there are any take-aways that I missed, please feel free to add them below!